Welcome to 2024 – a new year filled with well-worn headlines: war in the Middle East, Europe and Africa, recession fears and a looming Trump presidency.

What are we to make of these headlines? From an investment standpoint, very little. We crave certainty but we live, work and invest in a very uncertain world. We focus instead on the things that are less uncertain (inflation, retirement, death and taxes) and combine our opinions in these areas with decisions that tilt outcomes in your favour (optimally allocating your investments between business ownership, bonds and cash). This is our recipe for success. It has served our clients well for over 50 years and will continue to do so for the next 50.

Investment Comparison

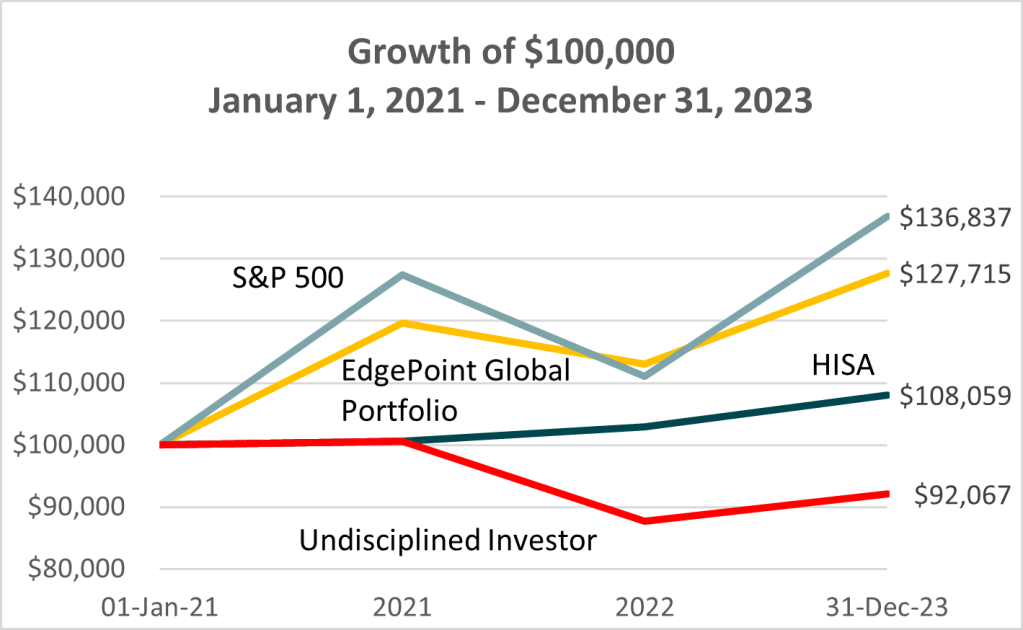

Let’s begin the year looking at three different investment solutions. Which of the following three investment choices: EdgePoint Global Portfolio. S&P 500 and a High Interest Savings Account (HISA) would have delivered the best results to an investor with $100,000 from the beginning of 2021 through to the end of 2023?

The answer is not simple. The investor who is unable to tolerate volatility is best off in the HISA. The investor with minimal concerns for volatility is best off in the S&P 500 index and the investor who wants to enjoy growth with some downside protection, is best off in the EdgePoint Global Portfolio.

But the most important lesson we can learn from this exercise is that the investor who bases their decisions on past performance (Undisciplined Investor) is the one who is at greatest risk.

This investor (still spooked from 2020) starts out investing in the HISA in 2021 then, seeing the great performance in the S&P 500, switches to it at the start of 2022 then moves back to the HISA in 2023 following a difficult 2022 and finishes the three-year cycle with less money ($92,067).

If nothing else, the past three years remind us that we can no more succeed in investing by looking at past returns than we can successfully drive a car by looking in the rear-view mirror.

| 1-Year | 3-Year | 5-Year | 10-Year | |

| CI High Interest Savings Fund (HISA) | 5.04% | 2.55% | n/a | n/a |

| EdgePoint Global Portfolio Series F | 6.82% | 8.04% | 5.56% | 10.23% |

| iShares Core S&P 500 Index (XUS) | 13.49% | 11.07% | 12.57% | 14.18% |

Additional Thoughts

Inflation & Interest Rates. While the consumer price index appears to be returning to a normal range (3.1% over the past 12 months to November 30 – down from its peak of 8.1%), the two most important components of the index, food and shelter, remain at stubbornly high rates running at 5.6% and 6.1% respectively (Source: Statscan.gc.ca). The Bank of Canada remains cautious on declaring the war on inflation over and have signaled that interest rates will need to remain higher for longer.

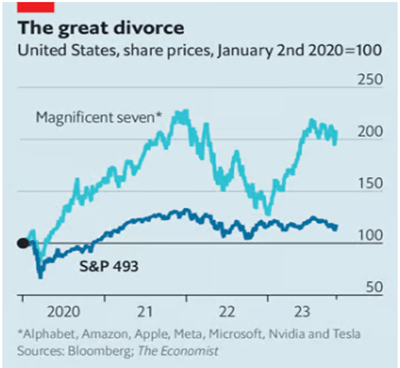

The S&P 493? Much of the spectacular performance of the S&P 500 over the past few years has been driven by seven businesses: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla. These businesses account for 29% of the index (in Canada, the top six banks account for 20% of the entire index). The other 493 stocks are older-economy businesses such as Berkshire Hathaway, Eli Lilly and JP Morgan Chase. These are all successful, innovative businesses who have not grown to the degree of the spectacular seven. We are well-served to understand what lies beneath the performance of an index such as the S&P 500 and to seek proper diversification. This is where these other 493 businesses become very important to our strategy and why it is important to look beyond indexes. (Source: The Economist)