Inflation

Canada’s inflation rate recently dipped back below 3%, moving within the Bank of Canada’s targeted long-term rate band of 1%-3%. Despite this encouraging development, the persistent reminder of escalating prices remains undeniable. A glance at the Bank of Canada Inflation Calculator reaffirms this reality. Today, my calculation revealed that an item priced at $100 in February 2019 would have surged to over $118 by February 2024. That’s a significant increase.

Sometimes on Saturday mornings, I indulge in a visit to our local Tim Hortons – treating myself to a breakfast sandwich, a chocolate chip muffin, and a tea. However, with the recent opening of Elmira’s first Starbucks, I decided to splurge and try their offerings instead. To my surprise, the same three items: an egg sandwich, tea, and a chocolate croissant, set me back $19.68 (including the $2 tip I was prompted to give). While the breakfast was enjoyable, the dent it made in my wallet lingers and I think I will head back to Tim Hortons in the meantime.

I’m thankful that I don’t need to eat at Starbucks to survive. However, in many other respects, evading the relentless impact of inflation proves challenging. That’s why we are pursuing growth in our investments, aiming to mitigate the effects of inflation on our lives. With that goal in mind, I share our investment and economic insights below.

Valuations Up

In the first quarter of 2024, valuations soared as investors anticipated forthcoming interest rate reductions. Warren Buffet’s timeless advice to “be fearful when others are greedy and greedy only when others are fearful” is particularly pertinent in such times. I don’t observe much greed – yet. This is a good thing. We are well-served to understand prevailing themes in the stock market as we journey on.

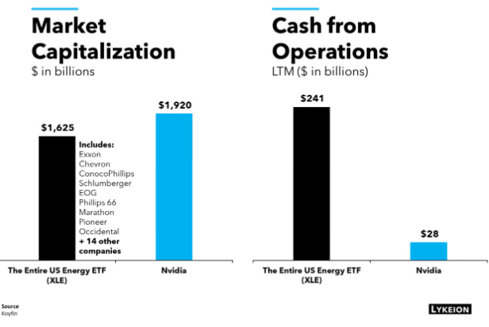

The first theme is the difference in valuation between mega-cap and all other businesses. Consider, for instance, the valuation of NVIDIA, a leading producer of chips for Artificial Intelligence applications. With a market capitalization (i.e. what it costs to buy the company) nearing $2 trillion and annual cash generation of $19 billion, NVIDIA yields less than 1%. On the other hand, investing in the 23 largest US energy companies, with a combined market cap of $1.645 trillion, yields close to $241 billion or 15% annually.

(Source: Lykeion)

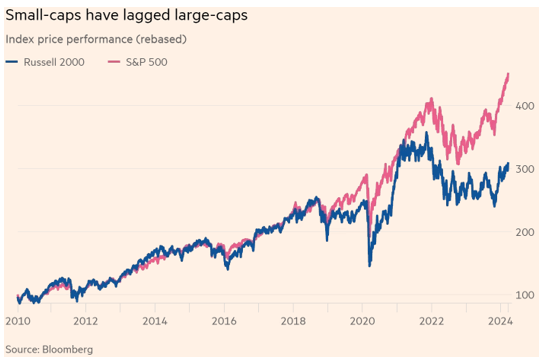

Small Cap vs Large Cap Stocks

Second, the growth in value of Small-cap stocks, valued at $2-3 billion on average, has trailed behind large (S&P 500) stocks, we believe there is significant opportunity in these smaller-cap stocks. It is easy to be in love with the S&P 500 based on its recent performance. We need to also exercise caution and understand the associated risks.

(Source: Financial Times)

Canadian Productivity

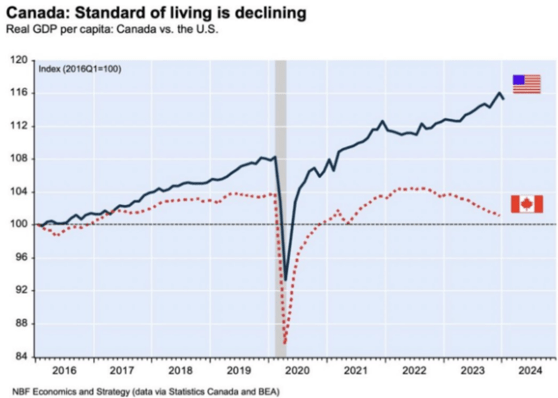

Last, the chart below shows that Canada’s productivity is lagging that of the US (Source: National Bank Financial). This is important because economic productivity enables us to financially protect what is ours. Our inability to grow our productivity puts us further behind and less able to pay for the things that matter to us collectively such as public health care, education and welfare. In short, because of these productivity gaps, our American neighbors have more resources available to pay for things, regardless of our political or ideological differences.

It’s crucial to note that a significant portion of your mutual fund investments are allocated to businesses located outside Canada, with a notable emphasis on the United States. The US economy has demonstrated remarkable productivity, resulting in increased profits and returns for business stakeholders. As investors, we reap the benefits of this heightened productivity.

Team News

In team news, earlier this month we bid farewell to Garrett Boekestyn who is pursuing an opportunity elsewhere. We will miss his good cheer and financial skills as we wish him all the best in his future endeavours. We also welcomed Christine Tullio to our team. She will be helping us out through to the end of tax season. Please be sure to welcome her as you call or stop by.