Let’s take a quick look back at 2021 even as we shift our focus to 2022.

Year of Vaccination

2021 was largely defined by the rollout of vaccines to curb the spread and impact of COVID-19 in Canada and the world. In the developed world this was a remarkable achievement with a vast number of people being vaccinated. In Canada, we progressed from less than 1% of our population being vaccinated at the beginning of the year to over 77% by the end (Source: Our World in Data). Even as we recognize this achievement, we acknowledge that there are issues as poorer countries – especially those in Africa – have been unable to procure and distribute vaccines to large portions of their population. This challenge may lead to a prolonging of the pandemic as new variants mutate over time. We remain hopeful that 2022 will be the year we put many of the impacts of COVID-19 in the rear-view mirror.

Increased Tension with Russia and China

As America continues to pull back from the world stage both Russia and China have begun testing America’s commitment to its ideals. China conducted record numbers of air force drills near Taiwan in October 2021 and has increased their insistence that Taiwan is part of China (Source: Washington Post). Russia, meanwhile, continues to threaten the independence of the Ukraine and has reportedly massed 100,000 troops on the border (Source: New York Times). It is unclear if either of these situations will lead to violence, but it is likely that the testing of America and its allies will be a theme going forward.

Inflation rearing its head

The pandemic and its effects have resulted in increased inflation. Canada’s inflation rate remained at 4.7% in November, the highest inflation rate we have seen since 2003 (Source: Economist). When inflation concerns were first raised earlier in 2021 much emphasis was put on inflation being transitory and likely to return to normal levels soon. Those predictions have been adjusted and it appears likely that higher inflation will remain for longer than originally anticipated.

There is much that is outside of our control as we have experienced through the last few years. As such, we do not spend our time predicting the future but instead we focus on what is within our control with appropriate asset allocation, tax planning and estate planning.

Looking to 2022 we return to similar themes as we examine the forces that will influence your financial plan in the coming years.

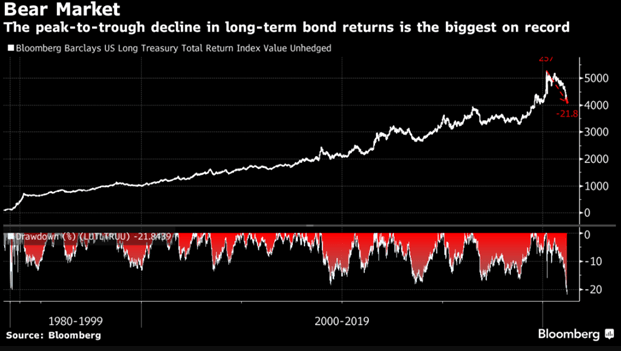

Inflation and increased interest rates

As noted above inflation is a serious concern in Canada and around the world. As governments look to curb inflation it is likely that we will see multiple interest rate hikes in the coming year. Although the Bank of Canada did not raise the interest rate at the end of 2021, it is anticipating raising interest rates between April and September of 2022 (Source: Reuters). Economists anticipate that there could be as many as four rate hikes by the end of 2022. This situation again confirms our belief that owning good businesses that can weather change and adjust is the best investment. Our approach to fixed income remains focused on shorter duration (which measures the amount of time we lend our money to others) and higher-yielding corporate debt.

Canada’s housing Market

According to the Financial Post, Canada has the second-highest housing bubble ranking in the world and there is significant risk of a pullback. One source of risk to Canadian housing is higher interest rates. The market share of variable-rate mortgages increased to 51% in 2021 up from less than 10% in early 2020 (Source: Financial Post). As the bank of Canada raises rates these variable rate mortgages (and eventually fixed-rate mortgages) will become increasingly expensive. Many Canadians have stretched themselves to afford homes in the recent housing market environment and an increase in interest rates is likely to squeeze the budget of many Canadians. As mortgages become less affordable this could drive down the price of homes throughout the country. Due to this risk, we work to create retirement plans that are not dependent on continuous price increases and eventual downsizing.

Short-term vs. Long-term

It is no secret that attention spans worldwide are shortening. This phenomenon is infiltrating investor mindsets. In the 1960s the average holding period for stocks was eight years. In 2020 the average holding period dropped to below five months (Source: Reuters). This short-term focus works against investors as it encourages damaging behaviour from investment managers such as closet indexing and high portfolio turnover. We also find that a short-term focus may tempt investors to chase short-term investment returns. ARK Invest is a US-based investment management firm that invests solely in disruptive innovation. Their flagship ETF (ARKK) dropped roughly 31% in 2021 while the S&P 500 finished up. The average investor in their ETFs is now estimated to have lost money (Source: Financial Times). This is why we work with investment managers who are focused on long-term results. These managers have established investment processes that keep them from chasing the latest short-term investment idea, instead focusing on fundamentals and long-term performance of the businesses in which they invest.

2022 promises to be a year of change as we emerge from the pandemic. We remain focused on your long-term financial health and look forward to working with you through the changes this upcoming year has to offer.