It has been a strong and encouraging year, both in markets and in our work together. We continue to be deeply grateful for the trust you place in us and for the opportunity to serve you and your families in a thoughtful, sustainable way.

One of the risks — in investing and in business — is that good years can make discipline feel unnecessary. Plans become easier to trust. Decisions feel more obvious. And it’s precisely at moments like these that we need to be the most thoughtful. This principle guides how we manage your investments and how we steward our practice for the long term.

Looking Back on 2025

Despite an unsettled global and domestic backdrop, markets delivered strong results this year. Equity markets advanced, and diversified portfolios were rewarded for staying the course.

Here in Canada, this was particularly instructive. Throughout the year, investors were confronted with trade tensions, tariff threats, political uncertainty, and persistent concerns about economic competitiveness. These were widely discussed and often framed as obvious headwinds for Canadian investments.

And yet, the TSX delivered very strong returns in 2025, driven by areas that remain foundational to the Canadian economy — banks, financials, commodities, mining, and precious metals. Once again, markets demonstrated that they are capable of absorbing uncertainty, pricing known risks, and moving forward based on earnings, balance sheets, and long-term demand rather than pessimistic narratives.

This served as a helpful reminder that what feels obvious or concerning in the moment is often already reflected in prices.

Gold and Bitcoin

2025 also provided a clear reminder of how differently speculative assets can behave: Gold Bullion (CGL.TO) finished the year up 60.6% while Bitcoin (BTC-CAD) finished the year down 12.9% (Source: Yahoo Finance).

These are large, attention-grabbing numbers — and they highlight something important. Assets like gold and Bitcoin do not generate earnings, cash flow, or productive economic output. Their returns depend almost entirely on what someone else may be willing to pay for them in the future.

For that reason, we do not hold either in client portfolios. Not because they cannot rise or fall sharply — clearly they can — but because we have difficulty understanding them as long-term investments rather than price-based speculation. Our preference remains to invest in productive businesses and assets whose value we can reasonably assess over time

What Actually Mattered

As we reflect on the year, it’s helpful to separate what felt important from what truly was.

What mattered less than it often seemed:

- Headlines and confident predictions

- Short-term enthusiasm or anxiety

- Attempts to anticipate a turning point

What mattered far more:

- Remaining invested

- Maintaining diversification

- Resisting emotional decisions

Your portfolios are not built to win any single year. They are designed to support your life — to provide security, flexibility, generosity, and peace of mind over many years and many market cycles.

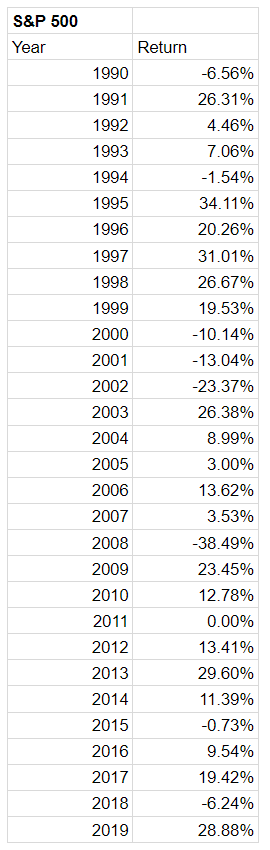

A Gentle Reminder

If investing feels easy today, it’s worth remembering that it won’t always feel this way. There will be future years when markets are uncomfortable, values are lower, and patience feels costly.

We don’t need to go back very far to remember those moments of doubt. Consider the following peak-to-trough returns of the S&P 500 over the past five years:

- Down 34% during the first quarter of 2020

- Down 25% between the first and third quarters of 2022

- Down 19% between February and April 2025 (Source: Yahoo Finance)

Our commitment does not change with market conditions. We remain focused on discipline rather than prediction, process rather than headlines, and long-term stewardship rather than short-term results.

Looking Ahead

We are grateful for the trust you place in us and for the opportunity to walk alongside you in your planning — not only with investments, but also with tax considerations, charitable giving, estate planning, and decisions that affect your families.

In the coming weeks, we will turn our attention to tax planning items such as TFSA, FHSA and RRSP contributions. Please be on the lookout for our communications – or feel free to call us to discuss next steps.

Thank you for the confidence you place in our work. We look forward to continuing the journey with you in 2026 — whatever it may bring.