Happy Thanksgiving. I recommend gratitude – if for no other reason than the compelling evidence supporting the notion that when we are grateful we are happier. The current news cycle does little to make me feel grateful: high interest rates, the Ukraine conflict, US budget talks and economic malaise in China. September’s negativity arose from expectations of prolonged high interest rates.

Love & Money

In a recent study, the Journal of Consumer Research unveiled compelling evidence suggesting that heightening financial interdependence bolsters the quality of relationships for newlyweds, potentially extending its positive effects beyond the initial stages. The researchers conducted an experiment involving engaged couples, with one group merging their finances upon marriage, while the control group maintained separate financial accounts. After a span of two years, the merged-finances group reported greater satisfaction in their relationships (notwithstanding all the wealth creation and tax planning benefits). It seems my mom was right all along.

Financial Advice & Old Age

The Centre of Excellence in Population Ageing Research recently released a study concerning financial decision-making in elderly individuals. The paper highlights the risks associated with the combination of heightened stakes and cognitive decline as we age. In other words, the impact of our financial choices becomes more significant, even as our capacity to make those decisions diminishes. This underscores the importance of refining the framework in which our financial decision-making takes place. An effective decision-making framework will encompass elements such as a streamlined or well-defined range of choices, appropriate education, gentle guidance or recommendations, alternatives, and personalized coaching. The next time you face a significant (or minor) financial decision, I recommend taking a moment to analyze its underlying structure. Are you positioning yourself for success in your approach? A thorough grasp of this concept will sustain the quality of your financial decisions as you grow older. We are pleased to be a part of this process with you as needed.

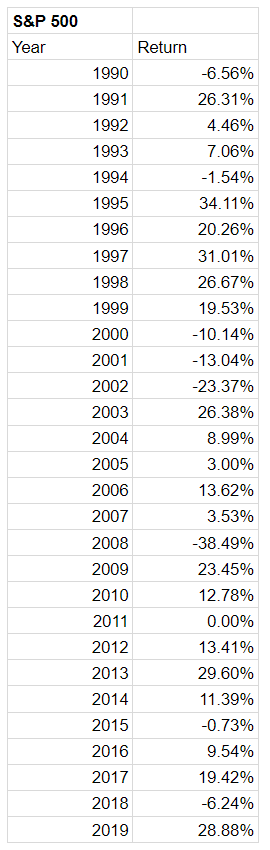

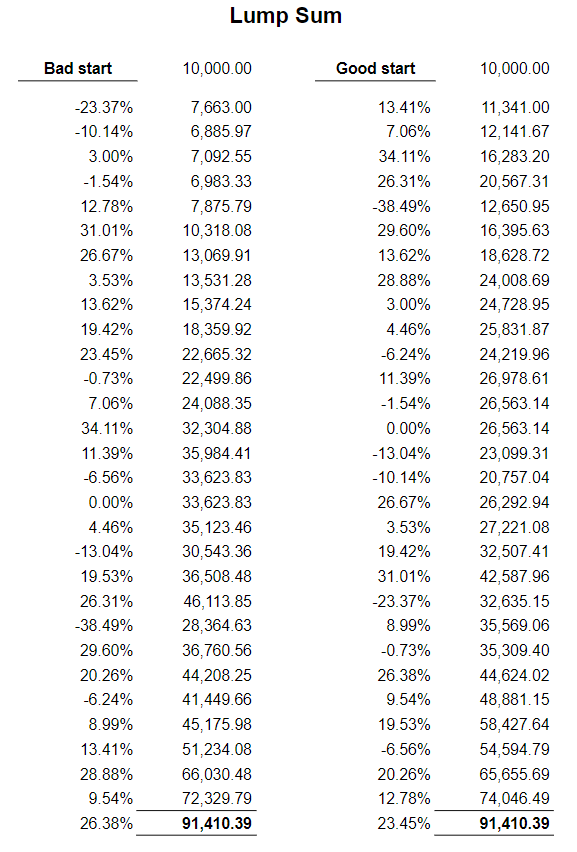

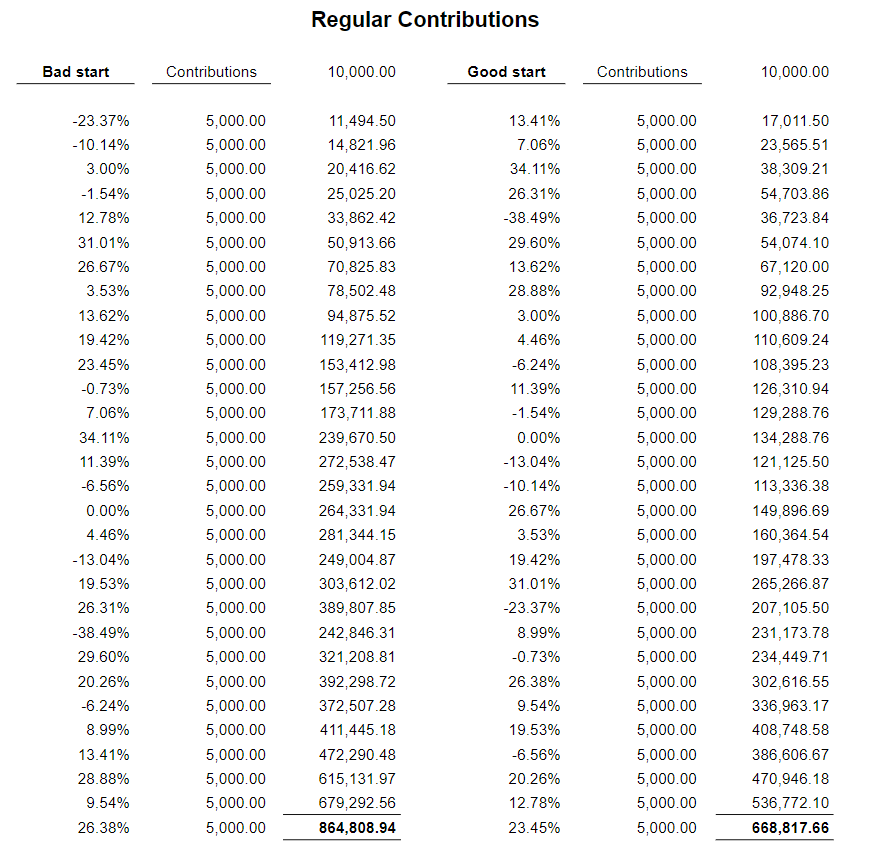

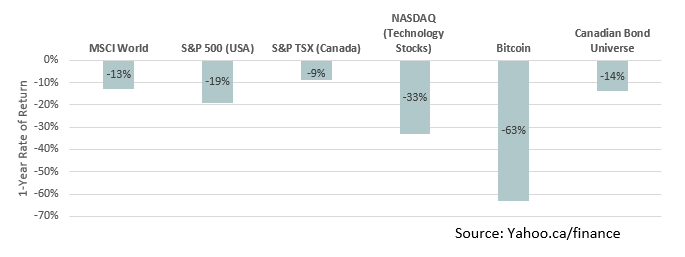

Cash & Risk

You might be curious about why cash could be considered a risky asset. In the current financial landscape, we have access to some of the highest interest rates in years, with investments like the CI High Interest Savings Fund currently yielding over 5%. So, where does the risk come into play? It emerges over the extended horizon. Charlie Munger, Warren Buffet’s longstanding investment partner, remarked at a recent Berkshire Hathaway meeting, “In the long run, virtually all currencies tend towards worthlessness” (he used more colorful language in his statement). I found his matter-of-fact delivery remarkable. However, upon reflection, I realized that given my life experiences, I shouldn’t have been surprised at all. On my desk, I keep a $50 trillion bill issued by the Reserve Bank of Zimbabwe. Recently, while tidying up my closet, I stumbled upon 5,000 Korean Won and 10 Philippine pesos. All three of these currencies are now essentially worthless. The caution to all investors is to be clear about the purpose of your money. It’s okay to keep it on standby for a period, but if this “cautious” approach leads to inaction, be prepared for the diminishing purchasing power of your assets over the long haul.